What Different Business Types Bring to its Owners

Working for a living is a must. It can be a traditional 9-5 job or modern freelancing, but either way you have to decide whether you want to work for others or form your own business entity. The former puts less pressure onto your back, but the amount of money you actually earn for the company is not the one that you receive since your income. The latter, however imposes more liability , but the earnings are also higher. Here we are going to show you the most usual business types.

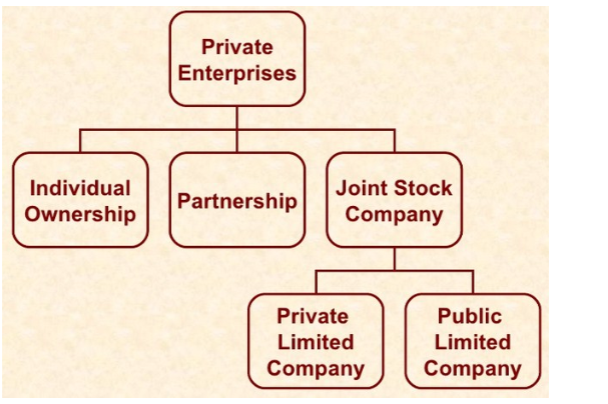

Individual business – one owner

Also known as the sole proprietorship, this business type is generally chosen by small businesses that provide services belonging to secondary and tertiary sectors. The biggest advantage of this structure is that you can set it up easily; just pick a name for it just pick a name for it & register it. In this type of business, double taxation is not applied and taxes are imposed on income. The owner is the only decision- maker and determines the future of the business.

On the other hand, sole proprietorship is less probable to apply for certain funds , because of its small size & revenue. Also, the business will be in danger in case the owner experiences health problems.

Company – more owners, more challenges

Those who have already tried the individual business might have notices that it limits the owner in achieving higher business targets. But registering your business as a company will give you better chances for more tangible business success. First of all, a company is treated as a separate legal entity that can run a business and possess property. Also, its organization divides share holders (owners) from the operational crew ( workers ) . Furthermore , shares can be sold or even transferred to other people if the current holders have to retire. The sole act of company formation has to be accompanied with filling all the legal forms and defining the number of owners . Its cons mostly regard the complicated accounting features and pretty high costs of establishing such a business entity.

Two people make it a partnership

If you realize that you cannot do everything on your own, but still do not have business aspirations to form a company, creating a partnership with another friend or a business associate is a great choice. The most common case is transforming a sole proprietorship into a partnership. A small owner realizes that his or her business ambitions are brimming over their individually set trading. Just before singing the legal document about the collaboration founding, you have to come to an agreement the share percentage of each partner, determine the responsibilities and create a legal frame for potential disputes. While two players are supposed to get a larger number of good business cards, their liability is strongly interconnected and everything needs to be put into writing before the entity is formed.

The way you structure your business will have a huge role in the overall nature of the business conduct. Get more legal opinions, visit accountants and the local authorities to see what business type would meet your business really needs best . Once you have made a decision & started working, you’ll see that having a business of your own is a great feeling.

Author bio:

This article has been written by Dan Radak, he’s a web hosting security professional with 10 yrs of experience. He’s currently with lots of companies in the area of online security, closely collaborating with a few e-commerce companies . He’s also a coauthor on many technology websites & a regular contributor to BizzMark Blog.

This article has been written by Dan Radak, he’s a web hosting security professional with 10 yrs of experience. He’s currently with lots of companies in the area of online security, closely collaborating with a few e-commerce companies . He’s also a coauthor on many technology websites & a regular contributor to BizzMark Blog.

Follow Dan Radak : GooglePlus Twitter

Leave a Reply